Peak bubble

It’s hard to see how this won’t end badly

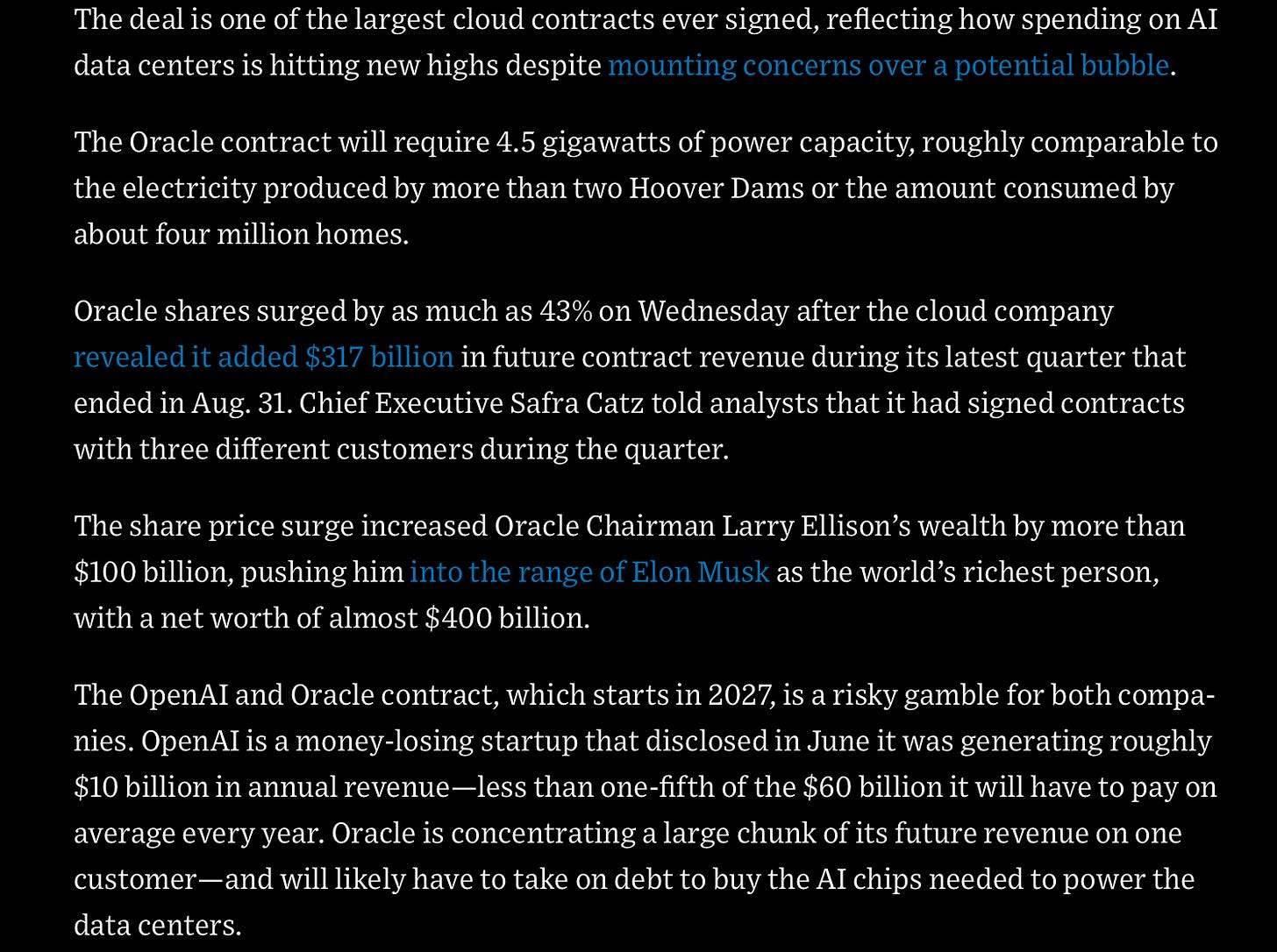

I don’t know when the GenAI bubble will end. But this has got to be peak bubble:

I quote the first bit:

In short

OpenAI doesn’t have $300 billion dollars

They don’t have anywhere near $300 billion dollars

By their own (presumably optimistic) projection, they won’t turn a profit until 2030.

And all this from a company thought (or claimed) that GPT-5 was going to be tantamount to AGI (spoiler alert: it wasn’t)

For good measure Oracle doesn’t have the chips they would need to fulfill the contracts, or even the cash to buy them.

I won’t say that it is all make-believe, but, well, you do the math. (Did people promising to build potential future greenhouses for tulip-growers in 1636 ever have it so good?)

If Oracle actually collects its $300 billion, I will truly be astounded. As Dan DeFrancesco at Business Insider wrote this morning,

Of course, having a backlog of deals (more formally known as “remaining performance obligations”) doesn’t guarantee they’ll all come to fruition. The revenue isn’t guaranteed, as contracts can be cancelled and the timing on all the deals isn’t clear.

Quoting investor Vinod Khosla from yesterday, “Most [AI] valuations are bonkers”.

Oracle’s new market cap, near a trillion dollars, up nearly 50% this week, driven largely by this one apparently non-binding deal with a party that doesn’t have the money to pay for the services, seems more bonkers than most.

§

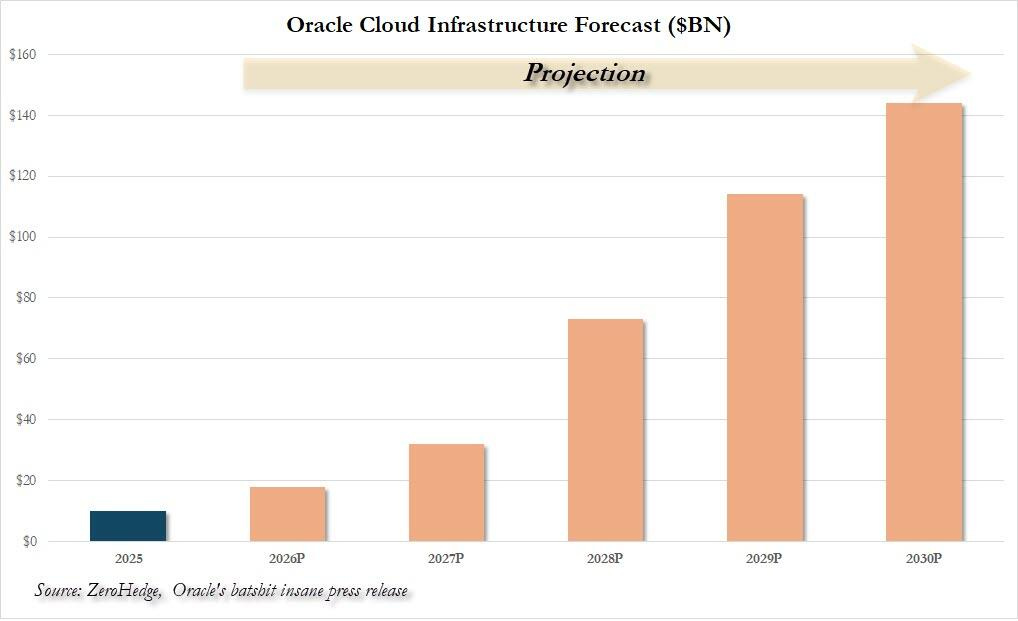

For those of you who like pictures, here is a chart of “Oracle's cloud revenue growth forecast” from an article at Zero Hedge. The recent increase in the company’s valuation is more than the total of the two projected bars on the right. And, reminder, those are for revenue, not profits.

“Batshit insane.”

§

It’s not just Oracle, though. The other problem here is that the total value of the tech market as whole, which is supposed to reflect the future of value of the companies within it, far exceeds what is likely ever to be delivered.

An investor who is regular reader of this Substack put it to me this way in email yesterday:

If people really believed ORCL was going to take all of this cloud business, then MSFT, AMZN, GOOG and CRWV stocks should be getting hammered by an equivalent amount, because this is all coming out of them. Yet all these equities are up (CRWV by 20%), with the exception of AMZN, which is slightly down.

When they all start coming out with similar baloney, you will be able to add it all up, and come to the conclusion that 400% of GDP is future revenue and that 50,000 nuclear power plants will need to be built to power this stuff, a few new oceans will need to be discovered to cool everything, and a new continent or two will need to be found for the datacenters.

We are well past peak bubble, in fact, and into peak musical chairs. It’s not going to be pretty when the music stops.

Nice! How about you, me, and your investor friend create an AI company and just start making things up. I'll write software, you do philosophy and innovation, and your other friend can go tell VC that we're about to build a Dyson Sphere and tap into the consciousness of the universe or something. All we need is 14 Triliion dollars. 😎

I was amazed that the actual business press didn't do any of the math. Just hastily published a number of fluff pieces on how everyone was just awestruck by the forward-looking (!) projections. As much as I want to just blame Tech Bros, you can't help but equally blame capital markets, analysts/press who do effectively zero research, and the passive investment rules that elongate (and worsen) bubbles. I don't see how this doesn't end very, very bad.